Underwriters, Throw Out Your Rubber Stamps!

‘Twas the night before lockdown, March 20th, 2020. As the office descended into chaos around me, underwriters raced to solve their looming existential crisis:

Stamping contracts – at home – without a printer.

Yes, I know. It sounds ridiculous.

But the reality was that international (re)insurance business was wholly unprepared for a digital sign-off process. Suddenly, an alternative to physically printing, stamping and scanning contracts was desperately needed.

In the wake of this radical shift in the underwriting workflow, my co-founder and I built a digital stamping tool called Stamper. Stamper enables rapid and painless stamping and signing of digital documents, no printing or scanning required. And the best part is…

Ahem, I am getting ahead of myself!

Before we dig into how Stamper can help you streamline your document sign-off process, I want to briefly discuss:

Aaaaand then I will explain how Stamper is the easiest way to sign and stamp documents, all without having to get up from your office chair.

Join me as we dive into the (riveting) world of contract stamping in the (re)insurance industry.

Contracts in (re)insurance

Insurance is a form of risk transfer in which one entity, the insured, receives protection from another entity, the insurer. The insurance policy, which is formalized by a contract, contains all of the relevant definitions, conditions, exclusions and parameters that describe how the coverage reacts (or doesn’t react, as the case may be).

As a consumer, you’ve probably read through an insurance policy or two. They aren’t typically very long. They tend to be quite standard.

In the realm of corporate insurance – insurance for large organizations – and reinsurance – insurance for insurers – things are more complicated. Coverage is typically provided in tranches of millions of dollars and can be specific to different lines of business, for example Marine and Energy or Liability. As a result, contracts tend to be longer and more complex.

To give you an idea, as an Assistant Underwriter in Specialty Reinsurance, I often saw queues at the printer while 200- to 300-page contracts were printed…one…page…at…a…time…

The underwriting process

Now that we’ve got a feel for contracts, let’s see how they fit into the underwriting process. Pretend for a second that you are an underwriter.

One morning, you receive a submission from a broker with data for a potential insured. You analyze the data in the context of quantitative model output and assesses the portfolio-level impact of adding this risk to the pool of all risks that you have underwritten. You also weigh in qualitative factors such as your relationship with the broker and whether he is a generous buyer of red wine. 😉

Let’s say you’ve weighed all of the various factors and this deal looks like a good one. You contact the broker to offer a “line”, the maximum dollar amount for which you will be on the hook if things go South. A line allocation process then takes place, during which the broker and/or the insured decide how to divvy up the program based on the line offerings that have been received.

If your line is “taken up”, the broker will then send you a contract to review. And, if you’re like many underwriters, your first reaction will be to hit the print button.

Ten minutes later, you collect your 314 page document from the printer and settle in at your desk to read the contract and stamp the required pages with your official rubber stamp.

You may be wondering, well, which pages do I need to stamp? Not all of them, surely?

Depending on what type of underwriter you are, I may have bad news:

Many underwriters, including Casualty Excess underwriters, typically stamp every single page of their contracts.

…

Now that we understand the problem at hand, we’re ready to look at potential solutions.

Existing solutions for document signing

In March, 2020, as Bermuda’s (re)insurance workforce prepared to don their sweatpants and work from home, signing contracts was suddenly the most pressing problem on everyone’s mind.

Few underwriters owned printers and even fewer owned scanners. And without these utilities, underwriters wouldn’t be able to apply their rubber stamps to officially sign off on new business.

Option 1, obviously, is purchase a printer.

I can’t say for certain how many underwriters elected to go with this option. However, given the typical length of contracts, I shudder to think of the money sink for printer ink!

Option 2, as you may be thinking, is Adobe Acrobat. Adobe has signature functionality – why not use that?

Adobe does indeed allow you to sign documents, however you can only have one signature; this wouldn’t work very well for underwriters, many of whom have multiple ways of signing off a document (rubber stamps, signatures, initials, etc.).

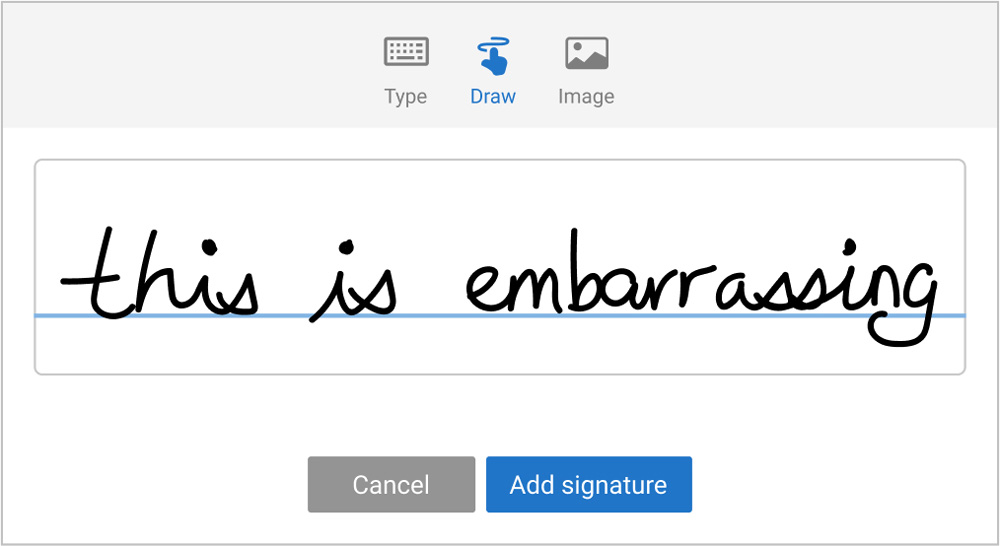

Moreover, Adobe also doesn’t make it easy to add a professional-looking signature. Your three methods are:

- Typing a “signature”.

- Drawing a signature with your finger or mouse.

- Uploading an image of your signature.

Method 3 sounds good, but you’ll need to be comfortable sending a photo from your phone to your work computer, removing the background of the photo and resizing the extracted signature.

I can count on one hand the number of people with image editing software who worked in the underwriting department. (Me).

The last sticking point with Adobe? You can’t stamp multiple pages.

I’ll let this sink in as you visualize your rubber stamp and your ink pad and your desk, which is covered with stacks of contracts that are starting to look really, really tall.

Enter, Stamper.

Stamper – the easiest way to sign & stamp documents

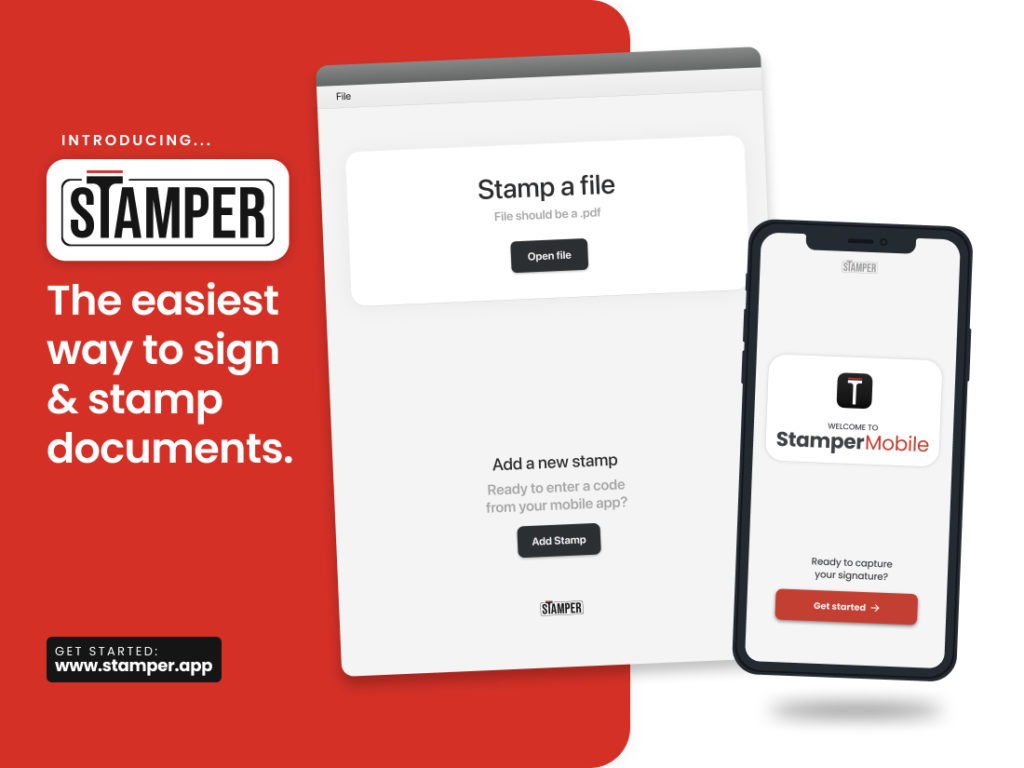

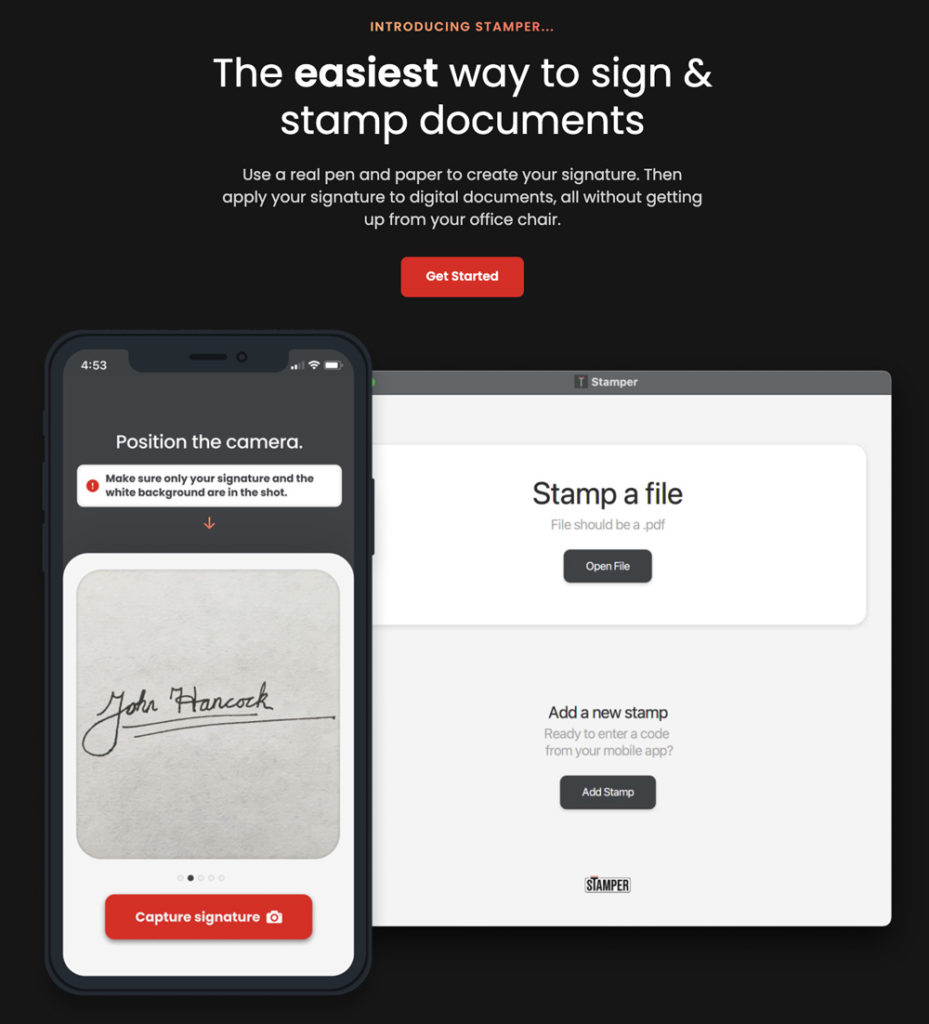

With much excitement, I would like to introduce you Cactus Ltd‘s newest app: Stamper.

We’ve created a dead simple PDF reader that is specifically geared toward signing documents. To that end, Stamper allows you to:

- Effortlessly add new stamps/signatures without image editing software.

- Use multiple stamps/signatures plus text annotations.

- Stamp/sign multiple pages with one click.

These three key features make Stamper the ideal solution to the underwriter’s contract stamping problem.

Let’s look at each feature in more detail.

Adding new signatures

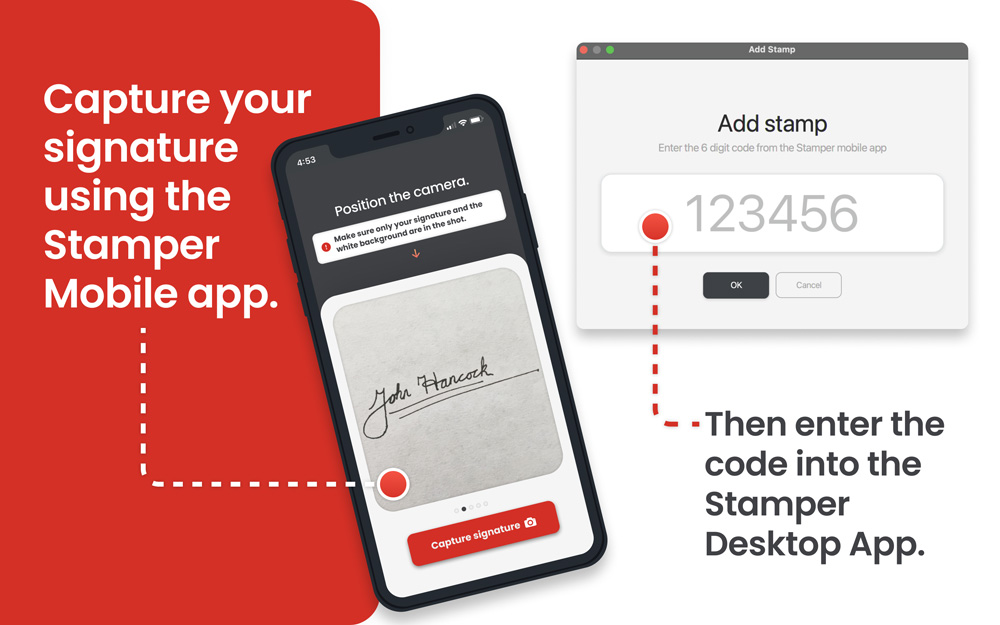

With Stamper, adding a signature doesn’t require you to “sign” with your finger or use photo editing software. You don’t even need to talk to IT.

Instead, you:

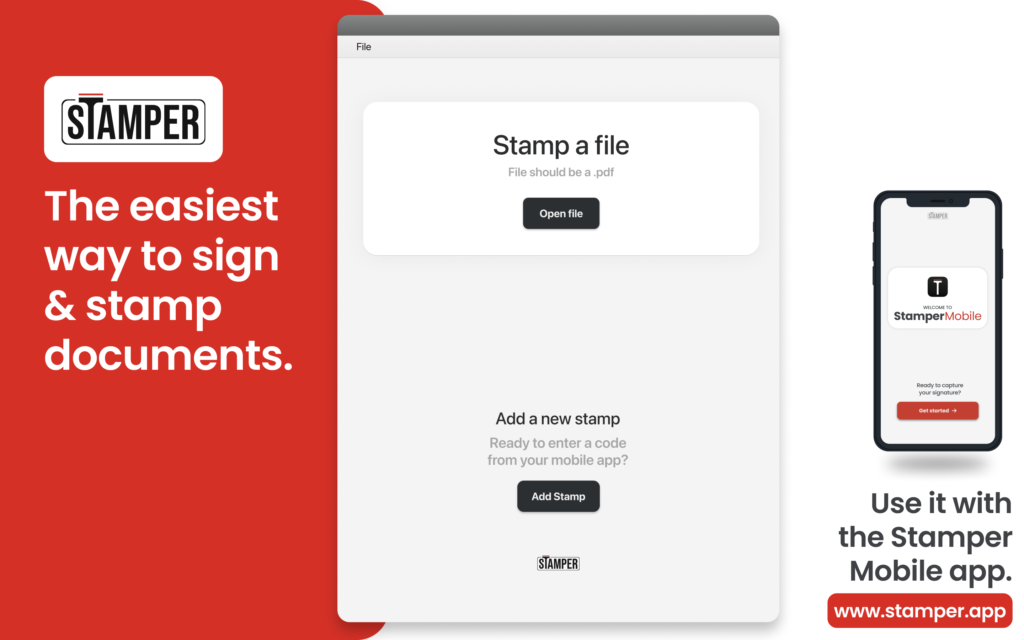

Download the Stamper Mobile app on your phone and the Stamper Desktop app on your computer. 👉 Direct download links 👈

Then:

- Open the Stamper Mobile app and follow the instructions to take a photo of your signature, getting back a 6 digit code.

- Open the Stamper Desktop app and enter the 6 digit code from your phone.

- That’s it. You’ll now be able to sign documents with your digital signature.

Lots of stamps? No problem

Throwing another wrench in the works: underwriters typically have different stamps for different types of business.

With Stamper Premium ($9/mo), you can add as many stamps/signatures as you like and choose which one to apply from a dropdown list. You can rotate and scale your stamps to fit any context or space constraint. Don’t worry, there’s an undo button!

Underwriters also commonly need to stamp documents and then apply a text annotation (such as date, line size or policy reference) on top of the stamp.

Stamper offers an easy way to add user-defined text to a document – it’s even in a handwritten font.

Stamping multiple pages

As mentioned in our discussion of contracts, many underwriters are faced with the monumental task of stamping every page in 100+ page contracts. Here’s where Stamper shines: simply right click, choose Stamp Multiple pages. Enter a range, then take the rest of the day off.

Did you hear that?

That’s the sound of underwriters everywhere breathing a collective sigh of relief.

Conclusion

In March 2020, a COVID-induced lockdown severed the connection between underwriters and their office printers, ushering in a new era of digital contract stamping.

Stamper fills a void within the PDF reader market for power users who need multi-page stamping and a user-friendly interface to add new stamps.

However, Stamper isn’t only for underwriters or lawyers.

We wanted to make it easy for all people who work from home who need to digitally sign and stamp documents without printing and scanning.

If you’ve ever filled out an application and then paid money to get it printed so that you could sign at the dotted line (I know I have…), I invite you to give Stamper a try. It’s free to get started.

And if you do deal with lots of documents and struggle with your existing sign-off process, you can upgrade to Stamper Premium ($9/mo) for unlimited stamps and multi-page stamping. Click here for a comparison of available plans.

Lastly, if you know someone who drowns in documents on a daily basis, please send them a link to www.stamper.app.

We are so excited to finally launch and thank you very much for reading! Give me a shout on Twitter @amypeniston. I’d love to hear your feedback.

Stamper Desktop is available for Mac and Windows; Stamper Mobile is available for iOS and Android. Click here for direct download links.

Photos in this post by:

- Image by ds_30 from Pixabay

- Sharon McCutcheon on Unsplash